A recent Wall Street Journal article highlights the price will increase in varied insurance coverage strains that small companies face, and the cutbacks that should be made to maintain afloat.

Rising insurance coverage prices symbolize the best supply of ache for small companies, the article states. Forty-two % of small enterprise respondents to a survey by Vistage Worldwide for The WSJ mentioned they’re seeing will increase of 10% or extra for insurance coverage.

“Roughly half of small enterprise homeowners mentioned medical insurance prices elevated by 10% or extra this yr, in line with a survey of about 800 entrepreneurs performed in June for The Wall Road Journal,” the article says. “Almost 1 in 10 reported will increase of 25% or larger.

“At Jay-Hill Repairs, insurance coverage premiums for well being, auto, and legal responsibility protection jumped by a mean of 20% this yr, properly above the 9% to 12% improve the corporate was anticipating. To maintain prices in verify, the Fairfield, New Jersey firm switched medical insurance carriers and not too long ago turned down three in any other case certified job candidates with spotty driving data that might have resulted in larger auto insurance coverage prices.”

Different kinds of insurance coverage have grown more expensive as a result of extreme record-setting weather and vehicle repair costs. Restore prices are on the rise, partially, due to the complexity of advanced driver assistance systems (ADAS), the necessity for pre- and post-scans and calibrations, and dealing with different high-tech and/or costly options and elements.

The article cites recent research by JPMorganChase Institute which discovered that healthcare bills made up practically 12% of payroll bills for corporations with lower than $600,000 in income in comparison with 7% for small companies with income higher than $2.4 million. The research checked out about 1,900 small enterprise medical insurance premium funds from 2018-2023.

The research notes greater than 94% of small companies within the U.S. have 1-49 workers, and 54% have fewer than 5 workers.

“Smaller corporations with fewer workers could also be much less capable of negotiate favorable insurance coverage premiums in comparison with their bigger counterparts,” the research states.

Gary Claxton, a senior vice chairman with well being coverage analysis group, KFF, advised WSJ one of the best ways for companies to decrease commonplace insurance coverage plan prices is to go for a smaller community of suppliers, elevate deductibles, or in any other case trim protection.

Some small enterprise homeowners are opting to proceed providing the perfect coverages they will as a result of, with out doing so, they worry they’d wrestle to stay aggressive in at present’s job market.

“We’re competing with the federal government for the labor pool. I’ve no alternative,” mentioned Shane Belcher, co-owner of Lyons Lumber, within the WSJ article. “Being a small firm, we have now to supply high quality insurance coverage if we need to appeal to high quality individuals.”

Nevertheless, he added that the upper prices paired with weakening gross sales would possibly trigger hiring delays to fill open positions, forcing the corporate to function with a smaller workers.

The results of a survey performed in 2023 by the Society of Collision Restore Specialists (SCRS) and I-CAR discovered that solely round 15% of the 839 technician respondents had been supplied medical insurance and/or paid day off on the time.

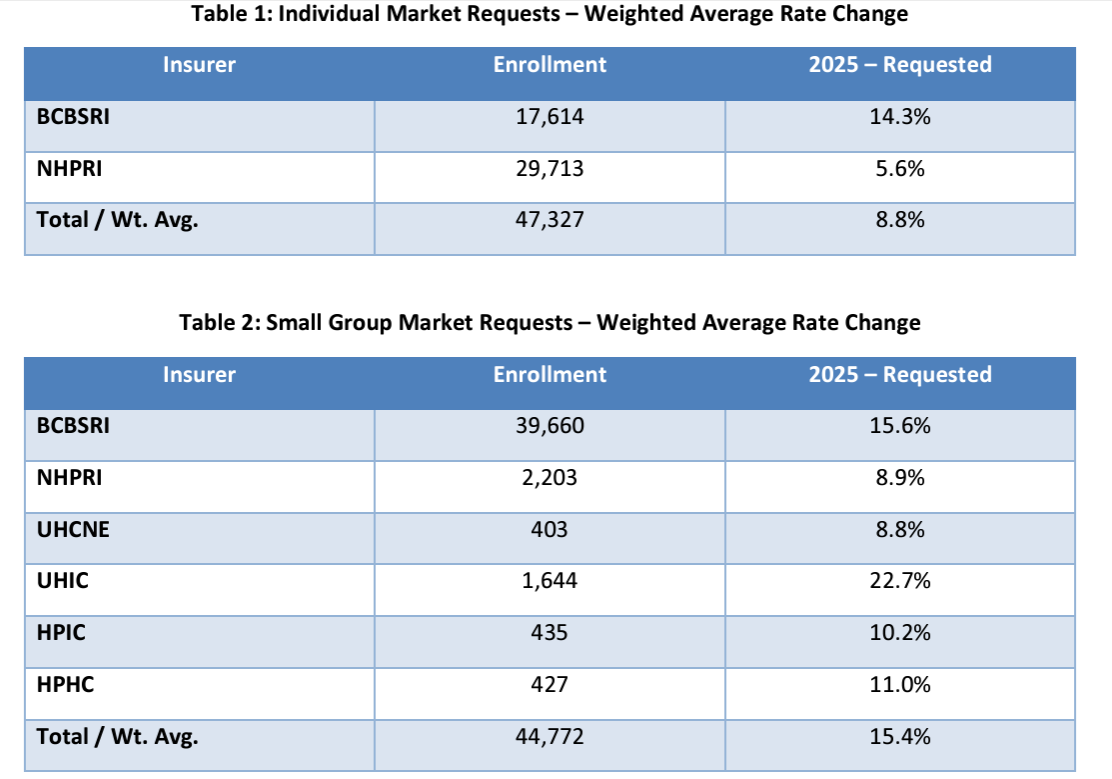

An instance of latest steep insurance coverage will increase comes from Blue Cross and Blue Protect of Rhode Island. BCBSRI has requested a 14.3% improve to 2025 premiums in its particular person market plan for residents who don’t have insurance coverage by way of their employers.

Small group insurance requests ranged from 8.8% to 22.7% from BCBSRI, Neighborhood Well being Plan of Rhode Island, UnitedHealthcare, Harvard Pilgrim Well being Care of New England, and Harvard Pilgrim Well being Care Insurance coverage Co.

Legal professional Basic Peter Neronha wrote in an Aug. 2 statement that the state’s insurance coverage commissioner shouldn’t approve the rise.

“[W]hen you take into account that BCBSRI has sought and acquired a mixed 21.6% improve since 2019, we’re now practically 40% in seven years,” he mentioned. “This premium improve is staggering, unfair, and positively doesn’t replicate enhanced accessibility… Well being care in Rhode Island is in determined want of systemic reform. Until and till this modifications, I cannot help vital insurance coverage charge will increase.”

The AG performed an unbiased assessment of the speed filings and supplied his suggestions to OHIC,

If permitted, greater than 17,600 Rhode Islanders enrolled with BCBSRI could be affected, doubtless together with small companies. Between 2019 and 2022 the typical permitted charge by OHIC within the particular person market was 3.4%, according to The Providence Journal.

BCBSRI’s charge will increase are as a result of hovering drug prices and nationwide larger use of medical providers post-pandemic, in line with a press release offered to The Journal by the insurer’s spokesperson Wealthy Salit.

“In 2023, BCBSRI’s claims for medical providers elevated $85 million from the earlier yr whereas claims for prescribed drugs jumped $75 million, leading to an working lack of $26 million,” Salit wrote, in line with The Journal. “The elevated well being care value developments have continued into 2024. BCBSRI is dedicated to main entry to high-quality, inexpensive, and equitable healthcare.”

By way of SCRS, collision repair businesses are offered as much as 20% in financial savings versus renewals and workers can use protection as quickly as they enroll. Protection is out there to employers with as few as two workers.

Advantages embrace:

-

- $0 deductibles and workers select their out-of-pocket most, which ranges from $3,000-$7,000;

- No-cost providers for visiting main care physicians, specialists, pressing care, labs, or having X-rays;

- Free generic prescriptions and psychological well being providers; and

- Aetna and Cigna networks.

Particulars concerning the plans supplied will be discovered within the SCRS benefits center.

Pictures

Featured picture credit score: fizkes/iStock

Extra info

Share This: